The world’s first carbon border tax was introduced by the EU at the start of October 2023, with the aim of reducing carbon emissions. Its primary focus is to address an issue called ‘carbon leakage’ or offshoring emissions. This initial trial phase is focused on high emitting sectors, including cement, fertilisers, iron and steel, aluminium, hydrogen, and electricity. After this, CBAM will be gradually ramped up to include more sectors, until it comes into full force from 1 January 2026. Only then will the carbon price be charged.

If the goods you export to the EU fall under the scope of CBAM, your customers will be expecting this emissions data from you, and complying with reporting standards will require a comprehensive understanding of emissions produced in your supply chain and in your own production processes.

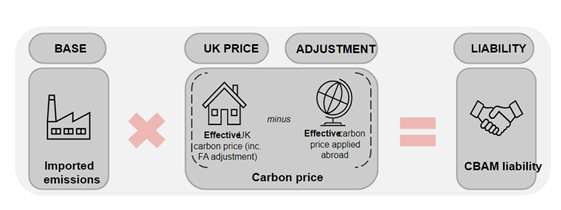

The government will implement a UK CBAM by 2027 and CBAM liability will lie directly with the importer of imported products within scope of the UK. It is crucial companies gain a full understanding of the embedded emissions within their supply chains.

How we can help

Knowing the complexities of CBAM can be hard for businesses, so to help we are running an Understanding the Carbon Border Adjustment Mechanism webinar.

Join our CBAM Specialists from Auditel - the UK’s leading carbon, energy and cost consultancy, who will be delivering this webinar on CBAM and its implications to UK exporters.

This webinar will cover:

• An introduction to carbon; its terminology and market forces

• An overview of the EU’s CBAM regulation; background, scope, terminology and approach

• What this means to UK exporters, and the opportunities presented

• A brief look at the proposed UK CBAM for UK importers

Date: Wednesday 27 November 10.00am to 11.00am

Virtual: Zoom Platform

Cost to attend: FREE