Understanding what a Commodity Code is, what is it used for, why it is important, and how you can find the correct one for your goods is crucial for international traders.

Many businesses have problems during the shipping process and having your goods stuck in customs, results in delays and additional costs. There are many reasons that goods can get stuck in customs, but attaching the wrong commodity code is one of the most considerable and easiest to get wrong!

Use of correct commodity codes prevents delays in goods arriving at their destination and incorrect duty payments, so it is important that you research and select the correct code.

What Is a Commodity Code?

A Commodity Code is also known as a Tariff Code or a Harmonised System Code and are used by customs authorities around the world to classify and track goods movements when you are importing or exporting them.

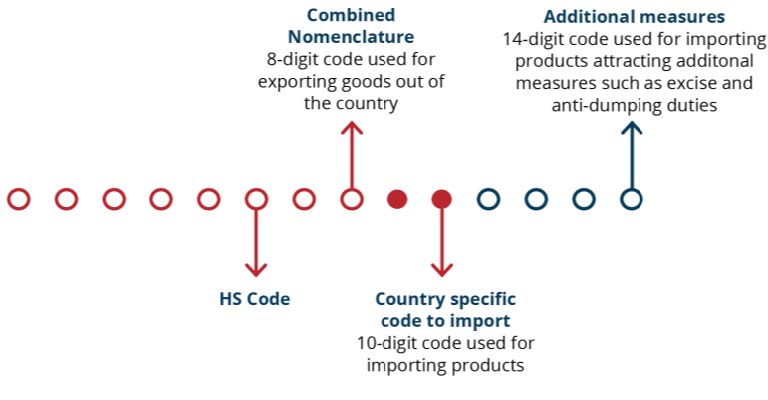

UK Commodity codes are made up of 6, 8 or 10 digits and you need to use the Trade Tariff found on the gov.uk website to look them up.

- The first six digits indicate the specific Harmonized System code for your product, these are internationally

recognised across the world, and are made up of the Chapter number, heading and subheading number of the product.

recognised across the world, and are made up of the Chapter number, heading and subheading number of the product. - The eight-digit code is used when exporting

- The ten-digit code is used when importing

Sometimes additional digits are used when importing goods which attract additional measures such as excise or anti-dumping duty.

While the first 6 digits of a Commodity Code are the same worldwide, individual countries have their own codes so these can vary.

Why do I Need a Commodity Code?

When trading internationally, most customs authorities require that you declare the kind of goods you are moving. The commodity code is the standard way, in almost all countries, to inform them about your goods.

They are essential for:

• Completing declarations and other paperwork.

• Finding out what rate of duty and import VAT you should pay

• Checking whether the duty is suspended

• Checking whether you need a licence to move your goods

• Checking if your goods are covered by specific policies, anti-dumping duties, or tariff quotas

As the exporter or importer, it is your responsibility to ensure your products have the correct codes attached to them which increases the chances of your goods passing smoothly through customs.

Do not trust the commodity code sent through by a supplier, particularly when importing. It may be the correct one for them but not for the UK. It must be checked against the UK’s (or other destination countries) import commodity code.

This is one of the main reasons UK importers have issues. If they do not supply the UK Commodity Codes for the goods being imported, and use the overseas commodity codes, they could incur additional costs and additional problems with HMRC.

If you are raising import documentation for entry to another country - on behalf of your customer for example, you must check the Tariff codes for that specific country to avoid problems and cost with their customs authorities.

There are however, other things you need to get right, so remember to check the other requirements for your goods.

What happens if I get my Commodity Code wrong?

It is always important to get all of your documents in order before exporting or importing. If the error is noticed while the goods begin their customs process, it will likely cause delays.

Getting things wrong can increase in transit-time and effect you, your customer and others in the supply chain. This especially effects manufacturers, where a delay can halt production.

If your goods are found to have the incorrect commodity code during or after the customs process, it is likely you will need to pay penalties. You may also end up paying interest on back-payments or have your goods seized entirely!

How do you work out your Commodity Codes?

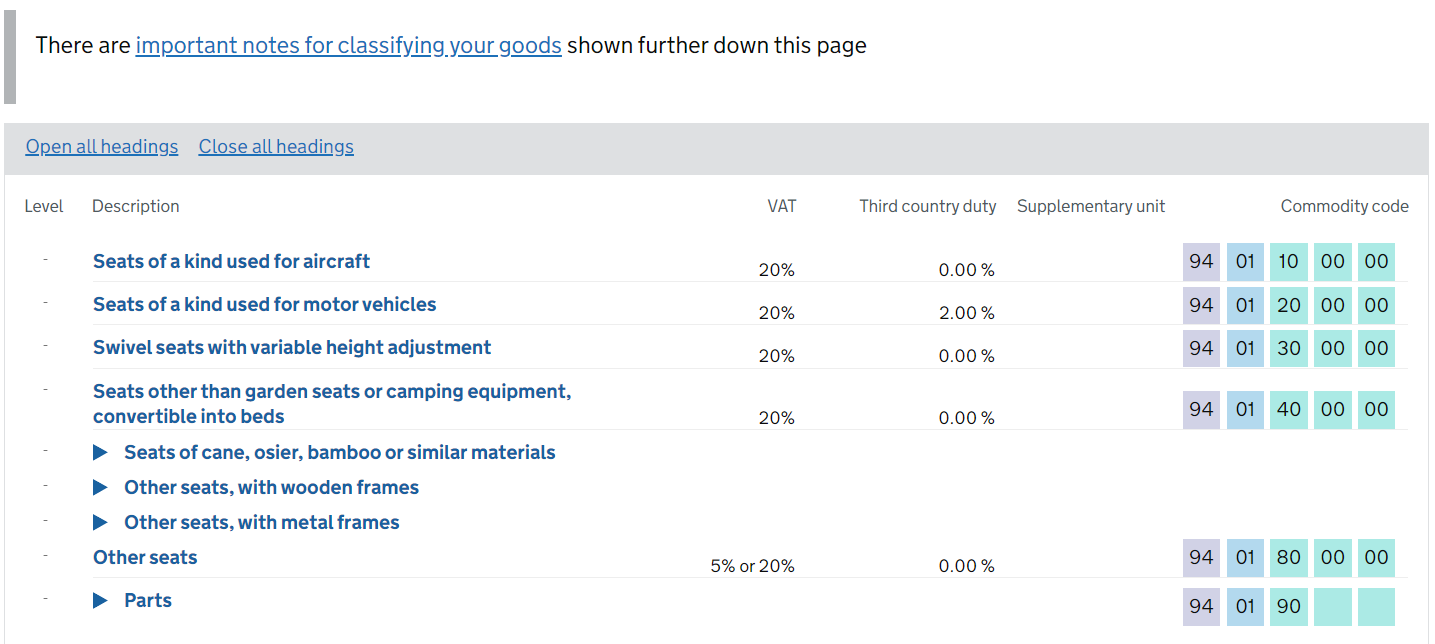

You will need to use the Gov.uk Trade Tariff Tool to work out the correct Commodity Code for your goods.

This tool allows you to find the right code by narrowing your search using information such as what your product is, how it is used and what it is used for, what it’s made from, how it’s made and how it’s packaged - so make sure you know these details before you start.

Finding the correct commodity code can be as simple as just find the code that best matches the goods in question but if you are unsure, or you can’t find the commodity code you’re looking for, you can ask HMRC for informal advice on the most suitable code for your product. You will need to email them separately for each product and include the following information

• A description of the product

• The materials it’s made from

• What it’s used for

• How it’s presented or packaged

HMRC can also offer "Binding Tariff Information Rulings" for goods that do not fit into a category. You may want to consider this if your goods are:

• hard to classify and informal advice is not suitable for you or your business

• a new type of product (this will be the first time the product will have ever been classified)

Find out more on HMRC’s Advance Tariff Ruling HERE

How we can help

Our virtual half day training explains Commodity Codes and gives you the understanding needed to confidently choose the right codes for your goods.

Date: Wednesday 26th June 2024 1.30pm to 4.30pm

Date: Wednesday 26th June 2024 1.30pm to 4.30pm

Virtual: Zoom Platform

Cost to attend: Members £250.00 + VAT and Non-Members £330.00 + VAT

In partnership with Essex County Council, we are offering all Essex Chambers Members Match Funding for two places on our Trade Expert courses. This will include our selected British Chambers of Commerce Accredited Training and extends to the individual courses that form part of our Academy Training, saving you 50% on course costs. Contact us to apply.